Custody & Child Support

Nevada’s New Child Support Law

Thoughts from a Family Law Attorney on the New Child Support Laws

Effective February 1, 2020, Nevada received a long overdue complete revision of the child support statutes. The two pages of previous statues is now 10 plus pages of guidelines. As this change just occurred, there is much to be learned as to how these will be applied and interpreted by the Courts. I have spent extensive time reading the statutes, and I have a few observations to share.

First, the new guidelines make it much easier for parties to stipulate and agree to a child support figure. This was always a difficult task under the old statutes as the Courts were bound by the law, which did not allow for much wiggle room.

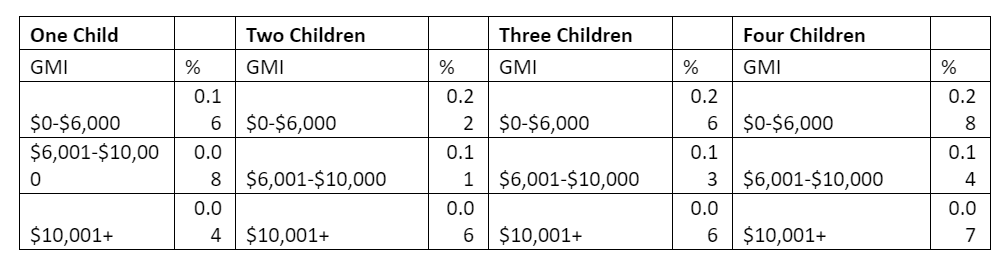

Second, unless you are a CPA or a Certified Family Law Specialist (I know shameless plug), calculating child support is much more difficult than before. The new formulas are equivalent to calculating your income tax based upon the respective tax brackets. Here is the new way to calculate support:

Additionally, this formula is not the be all/end all as far as the calculation is concerned. The guidelines also allow for the Court to modify the amount based upon the new formulas based upon other factors, such as the ability to pay. This essentially eliminates what were previously referred to as “deviation factors,” and gives the Court more discretion to modify the child support figure. This could get very interesting as far as advocacy goes as a family law attorney.

Third, there are no more statutory caps. With the removal of the statutory caps, I am finding in running various scenarios that a middle income earner with one child will be paying more than before and a high income wage earner will multiple children will be paying much less. Whether the old or new statutes are more fair, I guess depends on your perspective and situation.

Fourth, and most important, this new statute going into effect DOES NOT alone give a party the right to seek a modification of child support. The prior law in regards to modification remains in effect, which is you need to show a change in circumstances, which is usually a 20% change in income, or it has been three years since the last child support order.

If you have questions on the new child support change and want to see if a modification is possible and advised, call our office today at 775-622-9245.